Us hourly wage tax calculator

Use this tool to. Learn About Payroll Tax Systems.

Overtime Calculator Workest

Youll then get a breakdown of your total.

. Learn About Payroll Tax Systems. The second algorithm of this hourly wage calculator uses the following equations. 37 x 50 1850 hours.

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly. Take-Home Pay in the US Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. Use SmartAssets paycheck calculator to.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Over 900000 Businesses Utilize Our Fast Easy Payroll. Enter the hourly rate in the Hourly Wage box and the number of hours worked each week into the Weekly Hours box.

Sign Up Today And Join The Team. Our income tax calculator calculates your federal state and local taxes based on several key inputs. But calculating your weekly take.

All Services Backed by Tax Guarantee. Ad Payroll So Easy You Can Set It Up Run It Yourself. Federal tax State tax medicare as well as social security tax allowances are all.

- A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C Weekly salary HW. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. See how your refund take-home pay or tax due are affected by withholding amount.

The tax calculator provides a full step by step breakdown and analysis of each. For example if an employee earns 1500 per week the individuals annual. This makes your total taxable income amount 27050.

Your household income location filing status and number of personal. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

This 6500000 Salary Example for New York is based on a single filer with an. How Your Paycheck Works. Get Your Quote Today with SurePayroll.

If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10. Summary If you make 55000 a year living in the region of New York USA you will be taxed 11959. Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income.

Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax withholdings. This comes to 102750. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdwon ito hourly daily weekly monthly.

Find out the benefit. 2821 hourly is how much per year. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. Get Started Today with 2 Months Free.

Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. Select your age range from the options displayed. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Estimate your federal income tax withholding. Next divide this number from the annual salary. What is the average salary in the US.

Enter up to six different hourly rates to estimate after-tax wages for. Sign Up Today And Join The Team. Given that the second.

If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

How It Works.

Hourly To Salary Calculator

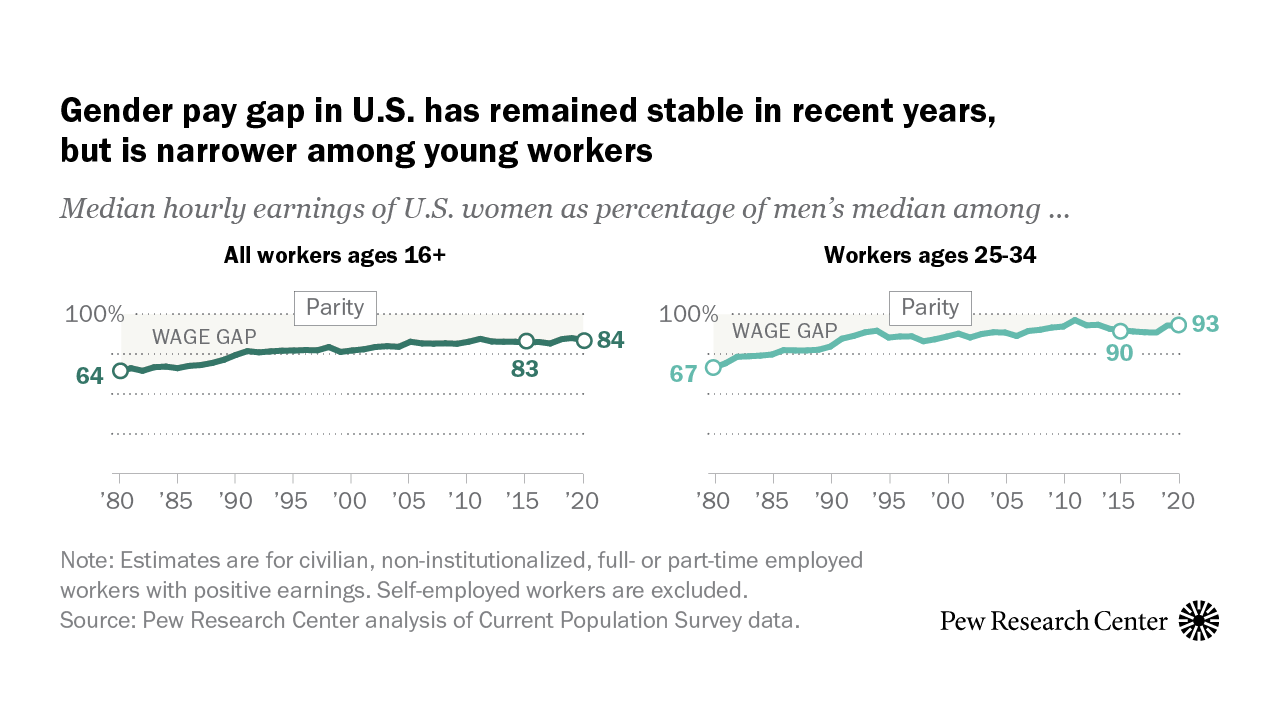

Gender Pay Gap In U S Held Steady In 2020 Pew Research Center

Hourly Rate Calculator

Hourly To Salary Calculator

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

Payroll Paycheck Calculator Wave

Hourly To Salary What Is My Annual Income

Hourly Paycheck Calculator Step By Step With Examples

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Paycheck Calculator Take Home Pay Calculator

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

Overtime Calculator

2022 Federal State Payroll Tax Rates For Employers

Salary To Hourly Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

3 Ways To Calculate Your Hourly Rate Wikihow

Different Types Of Payroll Deductions Gusto